The Spring Budget is on the horizon with a plethora of stakeholders in the property sector calling on the government to prioritise the housing market by implementing bold approaches to help all potential movers.

Second and final steppers have found stamp duty land tax obligations to be a particular deterrent in recent years, with many claiming the entire system or at the very least, the threshold, in need of an overhaul.

In 2014, the sitting Chancellor, George Osbourne, set the threshold liable to pay stamp duty land tax at anything over £125,000.

At the time, the average UK home was worth £203,346 which meant the threshold protected 61% of the averagely priced UK home from stamp duty contributions.

Since then, house prices have increased, and the average home is now worth £244,729 whilst the threshold has remained the same. This has dragged more homes into stamp duty obligations, omitting just 51% of the averagely priced home from stamp duty liability.

Uncertain times for first and last-time buyers

Whilst first-time buyers (FTB) receive a £300,000 stamp duty relief, those looking to second step or make a final move are liable for huge sums of money. One in 10 homeowners over 55 now choose to remain in their property rather than downsize and lose money through stamp duty according to new research from Standard Life and Age Partnership.

Even FTBs could struggle because of current government initiatives aimed at helping younger buyers gain a foothold on the property ladder.

At the start of February, the government launched the First Homes scheme which would place a restrictive covenant on the property ensuring that it is only ever sold to local, eligible first-time buyers. The property would then always be sold at 30 per cent below the market value.

Whilst this scheme could help with affordability issues, those looking to sell the properties on could mean they are faced with a gulf between their home and the cost of a larger home once the 30 per cent discount is taken into effect.

The Financial Conduct Authorities recent ‘Sector Views Report’ also intimated that active Help to Buy users could be at risk in the event of an economic downturn.

The report claims the scheme’s success for homeowners depends on a buoyant market. Static conditions could lead to properties slipping into negative equity, making it more difficult to sell or restrict a homeowner from accessing remortgaging products.

However, these fears remain speculative and Help to Buy had helped 236,313 purchase a property using the Help to Buy Equity Loan up to June 2019. With the scheme set to end in 2023, the Budget could be an ideal time to launch alternative solutions which would help FTBs and stimulate the wider property market.

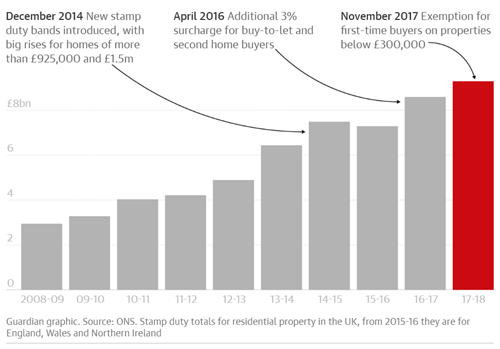

Despite more home sellers been caught with the threshold for stamp duty contributions, government revenue was still down 10% in the third quarter of 2018. With Stamp Duty Land Tax having grown significantly over the last 9 years, this downturn should be concerning to ministers dependent on the revenue generated by property sales.

As a leading provider of conveyancing searches in England and Wales, GlobalX can help provide efficient, fast and trusted search information. For draining and water searches, environmental searches, land registry searches, mining searches, miscellaneous searches and flood reports, our thorough and fast service will ensure the home buying and selling process is fully informed whilst avoiding harmful delays.

Matter Centre

Matter Centre